- #The best expense tracker that links bank account how to

- #The best expense tracker that links bank account Offline

- #The best expense tracker that links bank account free

These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. In the mean time, check out our SMS and Email alerts and online budget calculator to help with.

If you opt out, though, you may still receive generic advertising. Heres some of the best budgeting apps on the market. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

#The best expense tracker that links bank account Offline

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Record cash balances on hand or in your bank account. For example, a 7 day tracking period would be March 30th to April 5th. For each week, record dates you are tracking.

Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. The expense categories listed further below and on page 1 of the Expense Tracker will help you decide which expenses to record where. Securely link your accounts from multiple banks and track all your money from one. Relationship-based ads and online behavioral advertising help us do that. Discover the simple way of saving smart and spending smarter today. With Mint, you can see a list of your expenses under the Transactions tab and see an overall view of your spending habits under the Trends tab.We strive to provide you with information about products and services you might find interesting and useful. Mint also offers a search functionality that is useful when looking back on your expenses.īoth platforms make it easy to review your spending habits. This means you won't be able to dive right into YNAB's spending tracker. Available for free, Mint makes it easy to track expenses across multiple bank, credit card and investment accounts. When you first connect your bank accounts, past transactions will not be included in YNAB, whereas Mint will pull in the past 90 days worth of transactions.

#The best expense tracker that links bank account free

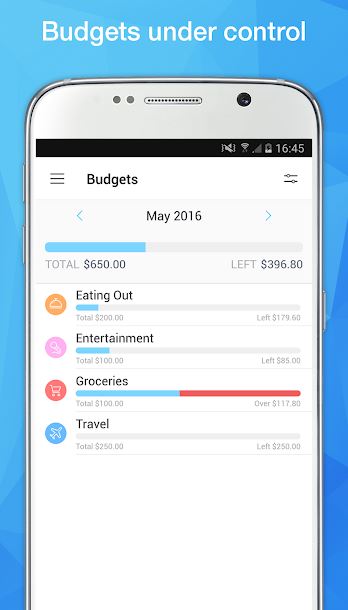

Mint is free, while YNAB is $6.99/month after a 34-day free trial. Compared to Mint, YNAB is described as a budgeting system rather than just a budget app. By linking your credit card and bank account to your Spendee account. Equity Account for Current Earnings: This account helps you track your profit (or loss) for the current financial year.When you close the financial year, the balance of this account is transferred to the equity account for retained earnings. Spendee is a great fuss-free expense tracker app that is suitable for any and everyone.

#The best expense tracker that links bank account how to

While not free, YNAB is a popular budgeting tool that is geared towards helping you create a budget and showing you how to save money. To set your accounts and banking linked accounts, go to Setup menu > Linked Accounts > Accounts & Banking Accounts. These popular budgeting apps connect directly to your bank account, automatically tracking your spending habits. There are plenty of budget planning apps but two, in particular, are consistently recommended: Mint and YNAB.

0 kommentar(er)

0 kommentar(er)